The European Union’s ambitions for the Digital Single Market aim to evolve the region’s skills and infrastructure to enhance citizens’ quality of life. In an increasingly technology-dependent society, a better digital ecosystem is essential to empowering citizens and working towards a more inclusive society. This is especially true regarding educational and work opportunities, and high-speed connectivity across the region is crucial to this goal. Thus, the expansion of the fibre network in Europe is an essential component.

Fibre rollout across Europe has already been a decade in the making. Now, bandwidth demand has intensified, and more operators are focused on FTTH/B to sustain the increase in traffic. This is backed by local authorities, who, in collaboration with private finance, are pushing broadband acceleration. Meanwhile, progress in micro trenching technologies is making installing infrastructure more straightforward than ever

However, this isn’t to say fibre expansion doesn’t face obstacles. The availability of skilled labour to drive this rollout is becoming more pronounced. Operators are having to look to alternative HR models to fill the gap, and meanwhile, red tape continues to cause project delays. It’s clear that to fulfil the EU’s ambitions for the Digital Single Market, we need flexible and agile strategies for fibre.

However, this isn’t to say fibre expansion doesn’t face obstacles. The availability of skilled labour to drive this rollout is becoming more pronounced. Operators are having to look to alternative HR models to fill the gap, and meanwhile, red tape continues to cause project delays. It’s clear that to fulfil the EU’s ambitions for the Digital Single Market, we need flexible and agile strategies for fibre. That said, the outlook for the fibre network in Europe is looking positive. That said, the outlook for the fibre network in Europe is looking positive, as evidenced by the FTTH Council Europe’s latest forecast for 2023-2029. We’ll discuss the state of play, projections and opportunities here.

Table of Contents

How surging demand is driving the fibre network in Europe

The explosion in bandwidth demand isn’t slowing down, and it’s driven by more than just increased internet usage. We’re seeing a fundamental shift in how we use the internet. Video streaming, once a novelty, now dominates our online experience, with high-definition content pushing networks to their limits. This, coupled with the rise of remote work and reliance on video conferencing and cloud applications, has placed unprecedented strain on existing infrastructure.

But it’s not just about human users. The Internet of Things (IoT) is expanding rapidly, connecting everything from household appliances to industrial sensors. Each device adds to the overall bandwidth load, creating a future where continuous connectivity is the norm. Factor in the demands of online gaming and cloud computing, and it’s clear that network providers face the ongoing challenge of meeting these evolving needs. Fibre optic technology, with its superior speed and capacity, is crucial to navigating this data-driven landscape.

By the end of 2024, EU39 is projected to have over 132 million FTTH subscriptions, with EU27+UK making up 67% of that figure. Looking further ahead, Europe39 is expected to reach approximately 201 million FTTH subscriptions by 2029, with EU27+UK accounting for over 143 million.

Current investment trends affecting fibre rollout in Europe

The European FTTH/B market is attracting serious attention from investors, and it’s not hard to see why. While 2023 and 2024 have seen a slight dip in investment compared to the peak in 2022, billions are still flowing into the fibre network in Europe. This sustained commitment from investors underscores the long-term viability and strategic importance of fibre optic infrastructure in Europe’s digital future.

According to the FTTH Council’s Investment Tracker, financing activity, including new funding and refinancing, has skyrocketed in recent years. Since 2016, investment has jumped from €892.5 million to over €27 billion in 2022, a clear indicator of the sector’s growth potential. Private and public funders alike are on board, with new initiatives from municipalities to accelerate the rollout supported by various national and transnational pledges (such as the Digital Single Market plan, already mentioned above).

Greenfield housing developments are equipped with FTTH/B as standard. Meanwhile, in more remote areas where the incentive for private operators to deploy is suppressed, local authorities are stepping in. Indeed, this makes increasing economic sense as remote workers show a preference for peaceful rural communities over urban zones. This is leading to some bold moves in some areas, where operators are switching off copper cable networks.

Beyond the raw numbers, it’s worth noting the increasing diversity of investors entering the market. We’re seeing not just traditional telecom operators but also infrastructure funds, pension funds, and private equity firms recognising the value and stability of fibre assets. This influx of capital from various sources is further accelerating the rollout of the fibre network in Europe.

Fibre infrastructure trends for the six-year period 2023–2029

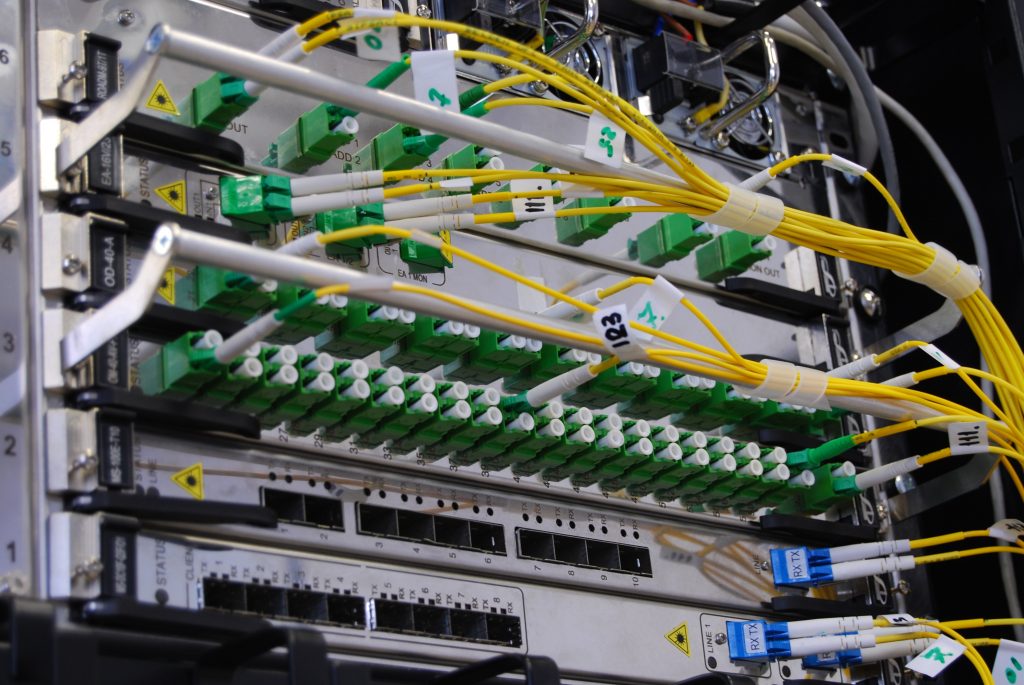

Regarding infrastructure investment, European countries are making strides towards a ‘Digital Society,’ with FTTH/B playing a key role in bridging the digital divide. The limitations of existing copper and cable networks, coupled with rising traffic demands, are driving the adoption of full-fibre solutions. National programs and the Digital Agenda for Europe (DAE) targets for 2025 & 2030 further accelerate this shift.

Interestingly, the fixed broadband market in historically copper and cable-based countries is transforming. Alternative ISPs are actively deploying FTTH in underserved regions, and incumbents are transitioning to FTTH, signalling full-fibre rollouts in countries like the UK, Germany, and Italy. In 2024, full-fibre infrastructure is estimated to pass 252 million homes in the region, including 164 million in EU27+UK. FTTH/B architecture is also evolving. While FTTH currently accounts for 35% of deployments compared to FTTB’s 65%, this is expected to change by 2029, with FTTB and FTTH accounting for 27% and 73%, respectively. By 2029, FTTH/B fibre network in Europe is forecasted to cover 312 million homes across the entire area, with EU27+UK accounting for 215 million.

Is there anything holding fibre adoption back?

However, there are two major factors keeping growth steady as opposed to exponential: uptake and skills. The gap between coverage and subscriptions in the European fibre network is clear; this could be due to a variety of factors, namely awareness and advertising standards. Some consumers are unaware of the benefits of FTTH/B vs. FTTC or feel that some operators’ claims are misleading.

The skills shortage is another significant hurdle. The fibre optic industry needs skilled professionals to design, build, and maintain these advanced networks. However, construction, a crucial area for fibre rollout, face a pronounced labour shortage. A recent RICS Global Construction Monitor survey revealed that 50% of respondents cited labour shortages as a significant concern.

The scarcity of experienced network designers further compounds the problem. While junior designers can be hired, tight turnaround times and the complexity of projects may increase the risk of errors or lower-quality work. This shortage of skilled professionals can lead to project delays and increased costs, potentially hindering the timely expansion of the fibre network in Europe. Certainly, you can take on more junior designers, but with tight turnaround times, the risk of lower-quality outputs rises.

Leveraging opportunities in the fibre network market

By 2029, Europe39 is expected to have approximately 201 million FTTH subscriptions, with EU27+UK accounting for over 143 million. The projections are optimistic, and to meet them, operators must ensure they’re taking full advantage of the market conditions. Coupled with EU targets, the increasing demand for bandwidth should carry the market along the path the FTTH Council predicts. However, there is potential for this to be pushed even further.

The key to truly eliminating the digital divide in Europe is talent. This is in regard to multiple challenges: first, infrastructure. If indeed experienced network designers are in short supply, how can the industry diversify its hiring practices in order to cast the net wider? Looking to the freelance market is an absolutely key strategy, especially in the context of the aftermath of COVID-19. According to a 2023 study by the European Forum of Independent Professionals (EFIP), 33% of the EU workforce are freelancers. This indicates a significant shift towards independent work within the European labour market.

These professionals are experienced, agile, international and available. Considering the fast turnaround times and geographical specificities, these fibre infrastructure experts are essential to high-quality, well-executed fibre rollout. The same goes for marketing; assuring consumer confidence is crucial to driving subscriptions and local expertise will be key to developing effective campaigns.

Source these professionals with Outvise

The European fibre optic landscape is poised for significant growth in the coming years. Driven by surging bandwidth demands and ambitious national targets, the expansion of FTTH/B networks presents a wealth of opportunities for industry players. However, addressing key challenges like consumer awareness and the skills shortage will be crucial to unlocking the full potential of fibre optics and achieving a truly connected digital society in Europe.

Collaboration and strategic partnerships will be essential to navigate these complexities and capitalise on the opportunities ahead. By embracing flexible workforce models and leveraging the expertise of freelance professionals in crucial roles like network design, project management, and marketing, companies can overcome talent gaps, accelerate rollout, and ensure a future-proofed network infrastructure for Europe.

Outvise can help you connect with highly skilled freelance professionals specialising in fibre optic network design, deployment, and management. Whether you need support with market research, due diligence, project execution, or sales and marketing, Outvise offers access to a global network of experienced talent ready to help you achieve your fibre optic goals.Explore the Outvise network and discover how freelance expertise can power your fibre optic projects. Connect with specialists such as Market Research Analysts, 5G Experts, Digital Transformation Consultants, and many other in-demand profiles now.

Take a look at our fibre experts:

Project Management & Execution

Pau Cerdà is co-founder of Outvise. Pau has founded several digital startups and consulting companies. He advised some major telecom and media groups. Former Oliver Wyman. Telecom Engineer + MBA (ESADE)

![[Updated] The business models that are attracting FTTH investment now](https://blog.outvise.com/wp-content/uploads/2022/08/FTTH-300x300.png)

No comments yet

There are no comments on this post yet.