Germany has exhibited the third-highest growth rate for FTTH deployment in Europe, with an increase of 66% compared to last year. But, despite these promising statistics, there is still much work to do. In the wake of the COVID-19 pandemic – which underlined the importance of high speed connectivity – fibre broadband installation is a national priority. The German government has outlined ambitious fibre rollout goals for 2025, but challenges lie ahead.

As part of the FTTH Europe Council’s Gimme Fibre Day initiative, Outvise invited some of our top fibre experts to analyse Germany’s current landscape and future. Michael Scholz and Ulrich Kramer, who combined have 50 years’ experience in the telco industry, shared their perspective on the current state of fibre rollout in Germany. In this overview, they cover market demand, funding streams, and how to pull together the team you need to overcome these obstacles.

If you haven’t yet, we invite you to watch the webinar here. With valuable insights and a compelling Q&A session, it’s well worth your time. Alternatively, for the essential briefing, keep reading.

Table of Contents

Why Germany is lagging behind its peers

Despite the weight that’s being thrown behind fibre rollout in Germany, the nation lags behind comparable economies. Currently, only 5.4% of German households have access to fibre broadband. Meanwhile, just over a third of these lines are actually active, with 36% of German consumers taking advantage of a fibre subscription. In comparison to other developed economies like South Korea and Sweden, whose fibre availability stands at 70%+, these numbers are fairly dismal.

So how did Germany, a central European country that otherwise excels in infrastructure, end up in this position? The reasons are largely historical: since the mid-1980s, in West Germany at least, customers had access to a coax-cable network (since upgraded to DOCSIS 3.x) that provides gigabit service. Meanwhile in the country at large, copper VDSL technology offers good service, which over the years, has been “tuned” by major incumbent Deutsche Telekom. In summary, the strength of the current infrastructure breeds an “if it’s not broken, don’t fix it” malaise.

Moreover, much of Germany’s infrastructure is underground. This makes replacing or upgrading lines logistically complex and costly, with works costing upwards of €70,000 per kilometre. Naturally, this price tag didn’t foster enthusiasm amongst state and local authorities when VDSL networks seemed to be doing the job. There’s also lingering hope that in rural areas 5G will pick up the slack when it comes to connectivity, mitigating the need to do any civil works in hard-to-reach areas.

However, the COVID-19 pandemic made the necessity of the fibre rollout hit home. As VDSL networks began to struggle under the weight of demand, fibre shot to the top of the agenda. Merkel’s “Digital Agenda” of 2017, which focussed heavily on fibre optic technology anyway, is now more urgent than ever. That said, challenges remain.

Ambitions and obstacles for the 2025 Digital Agenda

The Digital Agenda has set the bar for fibre connectivity in Germany. In the document published nearly five years ago now, federal authorities outlined ambitious plans to provide gigabit access for every household, enterprise and public institution in the country. It was stipulated that any new build network or network element must be fibre optic technology.

This translated to another 35 million households passed and connected and an enormous €12 billion investment. The plans also stated a preference for micro-invasive deployment methods. However, challenges still lie ahead, largely because of Germany’s political structure. To outline but one obstacle, despite the federal government’s fervour for fibre, the final say on civil works lies with local authorities. Even in the face of such healthy investment, municipalities remain skeptical about micro-trenching and are stalling projects.

Equally, the pandemic has presented as many obstacles along with the opportunities. Primarily, although it has driven the demand for FTTH broadband, the supply chain bottlenecks it precipitated have stifled rollout. With a shortage of products and personnel, projects remain on the backfoot. That said, this won’t last forever – so it’s crucial companies understand how to access the funding that’s available, and in turn, navigate the idiosyncratic German market.

Accessing the funding for fibre rollout

It’s no secret that there’s an enormous amount of public funding available; we’ve already mentioned the €12 billion investment from the federal republic. There’s also funds available from local authorities, making the funding pot even healthier. However, the challenge in a German context is accessing it. Rules for federal and state funds will overlap and contradict each other, and meanwhile, application processes are lengthy. German bureaucracy has somewhat of a reputation in Europe and this initiative is no different. Thus, expertise regarding German law and processes is essential.

Certainly, there are further opportunities in the private sector, but this also comes with its own quirks. Of course, large providers will fund projects with their balance sheet in mind and will want to see evidence of a strong business case. This has led to some interesting scenarios, where large operators are collaborating with locally strong infrastructure providers to share the burden of fibre rollout.

The purpose of these partnerships is to create synergies and access markets, where perhaps “local heroes”, as Michael called them, have greater appeal or market penetration than the big players. Meanwhile, smaller operators are showing interest in less attractive regions, as for them, there is a longer investment horizon. Ultimately, in rural areas, there’s less competition, so these customers are likely to stay with them longer.

The opportunities are out there, it’s just a question of accessing them; and on the subject of this patchwork of large and small operators, infrastructure companies, and other stakeholders, we’ll move onto why the German market is so difficult to enter.

An interesting but difficult market to enter

Before embarking on a fibre rollout project in Germany, it’s important to understand that these “local heroes” – small to mid-size construction companies and operators – are actually the bulk of the German market. Although there are larger foreign players, they tend to be focussed on the large municipalities. Therefore, an understanding of the inner workings of this landscape is absolutely essential to leverage opportunities.

This is because many of these local players come from a specialised infrastructure background, usually laying electricity lines or gas pipes. They understand the lay of the land (quite literally) and this gives them an edge over international players. That said, since the publication of the Digital Agenda, larger international civil engineering companies are showing greater interest in the German market.

However, they need to come armed with cultural knowledge as well as engineering expertise. As already touched on, German bureaucracy is complex and even the most experienced companies need expertise on local law and business practices. Perhaps most crucially, they need to be able to navigate the German environment in German. All local paperwork and regulations will be in the language, so a native-level command is indispensable.

Furthermore, the federal system in Germany demands further nuance. Just because you’ve done a project in Bavaria doesn’t mean it’ll be the same in Bremen, and so on and so forth. There has to be a willingness to navigate this complex market, from engaging with local law to a deep analysis of the potential customer base and scope of work.

This isn’t to imply that everything is like Kafka’s Castle; provided there is someone on board with a good knowledge of German, documents like Deutsche Telekom’s technical bible ZTV are very enlightening. Moreover, with constant testing and qualifying of the team, you can become a Deutsche Telekom five-star vendor. Although this takes diligence, once you have this certification, as Ulrich says, you can effectively print your own money.

Setting up the right team for fibre rollout

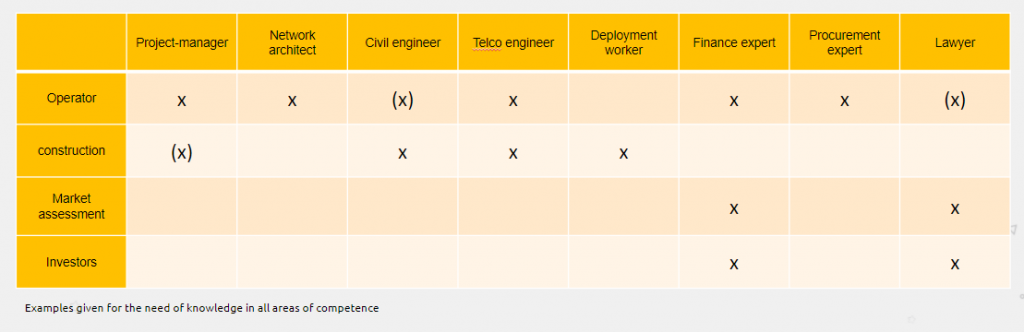

But in order to tap into this lucrative albeit tricky market, you need to put together the right team. You need people to navigate the regulatory environment, that is, German-speaking lawyers and procurement experts who can broker relationships with local players. You need people who can create partnerships with specialised contractors, particularly when it comes to processes like drilling or pressure management. Below is a table shared during the webinar outlining the necessary competencies at every level.

Fostering the brand is also crucially important, and some operators have even been known to draft in a fully-fledged service company. However, this comes at a cost, so many are leaning towards outsourced models. That said, the team needs to provide an end-to-end service with a group of professionals that have worked together from the outset. This makes the team effective, trustful, and although perhaps not working for the same company or under the same umbrella, cohesive.

In summary: Fertile ground that demands knowledge

To wrap up, Germany undoubtedly presents a compelling proposition for international investors and operators alike. There is certainly rising demand and a wealth of public funding available. Despite the country’s otherwise mature infrastructural landscape, fibre rollout has lagged behind, and in the wake of COVID-19, the time for investment and deployment is now.

However, to tap this market, and indeed the funds, you need expertise. The team needs to be familiar with the legal landscape at both a federal and local level, and from here, the capacity to broker relationships with local authorities and companies. This means experience in the German context, full command of the German language, and strong relationships with local players. Only then can a fibre rollout reach its full potential.

So where does one find these niche experts? The answer is Outvise. With a portfolio of more than 32,000 freelancers in 140 countries, companies can connect with experts like Michael and Ulrich in less than 48 hours. Take a look at the links below to find telecom and fibre experts for your specific needs, whether it’s a design, build, or support project:

Project Management & Execution

Or, if your project is still in development, we invite you to continue exploring our resources. Outvise is a member of all three FTTH councils in the EMEA area, as well as sitting on committees for operation and deployment, investment, and the “Women in Fibre” working group – so we have a wealth of knowledge to share. Download the free eBook “Supporting fibre network operations through their business cycle” to find out more about new opportunities in the fibre market and how to find the fibre specialised talent you need.

Ulrich is a Diplom-Ingenieur Broadband Consultant.

He has 30+ years of experience in the Telco business. Specialised in new fibre products in Europe, FTTx rollout.

Expert in turning key solutions for major players.

Due Diligence & market entry professional.

![[Updated] The business models that are attracting FTTH investment now](https://blog.outvise.com/wp-content/uploads/2022/08/FTTH-300x300.png)

![[Updated] The state of the fibre network in Europe from 2023-2029](https://blog.outvise.com/wp-content/uploads/2022/05/fibra-1-300x300.jpg)

No comments yet

There are no comments on this post yet.